Invest in South Africa

One of the leading economies in Africa, with a well-developed infrastructure and established trade links with the rest of the continent, South Africa is a suitable base for servicing a global customer base, while also providing access to the rest of Africa.

Should you require more information on setting up business in South Africa, please contact us on This email address is being protected from spambots. You need JavaScript enabled to view it. / +27 (0) 83 657 3112.

Brands currently in south africa

We have collated detailed information to assist you on your decision making process.

| Request Access to the latest South African Value Proposition |

South Africa’s GBS Value Proposition: 6S’s for Success

Strong foundation in contact centers and niche areas

- Deep domain knowledge in financial services

- Global delivery expansion from contact centers to non-traditional areas such as legal and healthcare, game development, mass communication & broadcasting, and learning management

Skilled and young English-speaking workforce

- Fluent English-speaking talent with neutral accent and high empathy levels

- Cultural affinity with the UK, Australia, and increasingly, the US

- Availability of large, young, and trainable talent pool, with strong understanding of technology

- Availability of talent across multiple cities; additional talent pool via impact sourcing

Sizable regional and domestic market opportunity

- Gateway to the African continent

- Large domestic market with increasing demand across telecom, BFSI, and retail industries

- Growing demand for digital solutions such as mobile payment systems, big data, and analytics

Significant cost savings

- 60-70% lower costs than the UK and Australia, 25- 35% lower than leading CEE locations

- Incentives further reduce costs to bring them in the range of costs in the Philippines and India

Sophisticated infrastructure and enabling environment

- Availability of robust infrastructure and high quality of life

- Government support at national, regional, and sectoral levels to boost infrastructure and skill development

- Global contact center standards – ISO 18295 is based on South African standards. Multiple companies are POPI and GDPR compliant and have achieved ISO certifications

Strengthening ICT and digital capabilities

- One of the best ICT infrastructures in Africa

- Shift toward tech-enabled value addition to enhance customer experience: Evolving capabilities in omnichannel, customer analytics and next-generation solutions such as cloud, cybersecurity, AI, ML, and big data & analytics

South Africa’s Global Business Services (GBS) Industry – Value Proposition Document

South Africa Global Business Services (GBS) Country Assessment Framework Snapshot

Business Process / Shared Services

Alternative legal services (ALS)

There is growing recognition of South Africa as an offshore location for alternative legal services (ALS) which includes debt recovery and credit lifecycle management services. First movers in the offshore market include multinational corporates, their legal service providers, multinational law firms and corporate legal departments. International, so-called ‘Magic Circle’, law firms have set up ALS delivery centres in South Africa, whilst some of these law firms have outsourced these services to 3rd party providers.

In summary, on evaluation of data gathered from global buyers and domestic service providers, the South African alternative legal services (ALS) value proposition emerges as:

- Diverse, proficient legal expertise and service delivery.

- Advanced legal talent and human capital.

- Digitised and automated, technology-enabled legal tools and platforms.

- Enabling business, investment and ICT infrastructure.

- World-aligned governance, legislative and compliance environment.

These are the core pillars that provide South Africa with a competitive advantage in the global legal services market.

Source: 2019 South Africa Alternative Legal Services (ALS) Market Intelligence Report

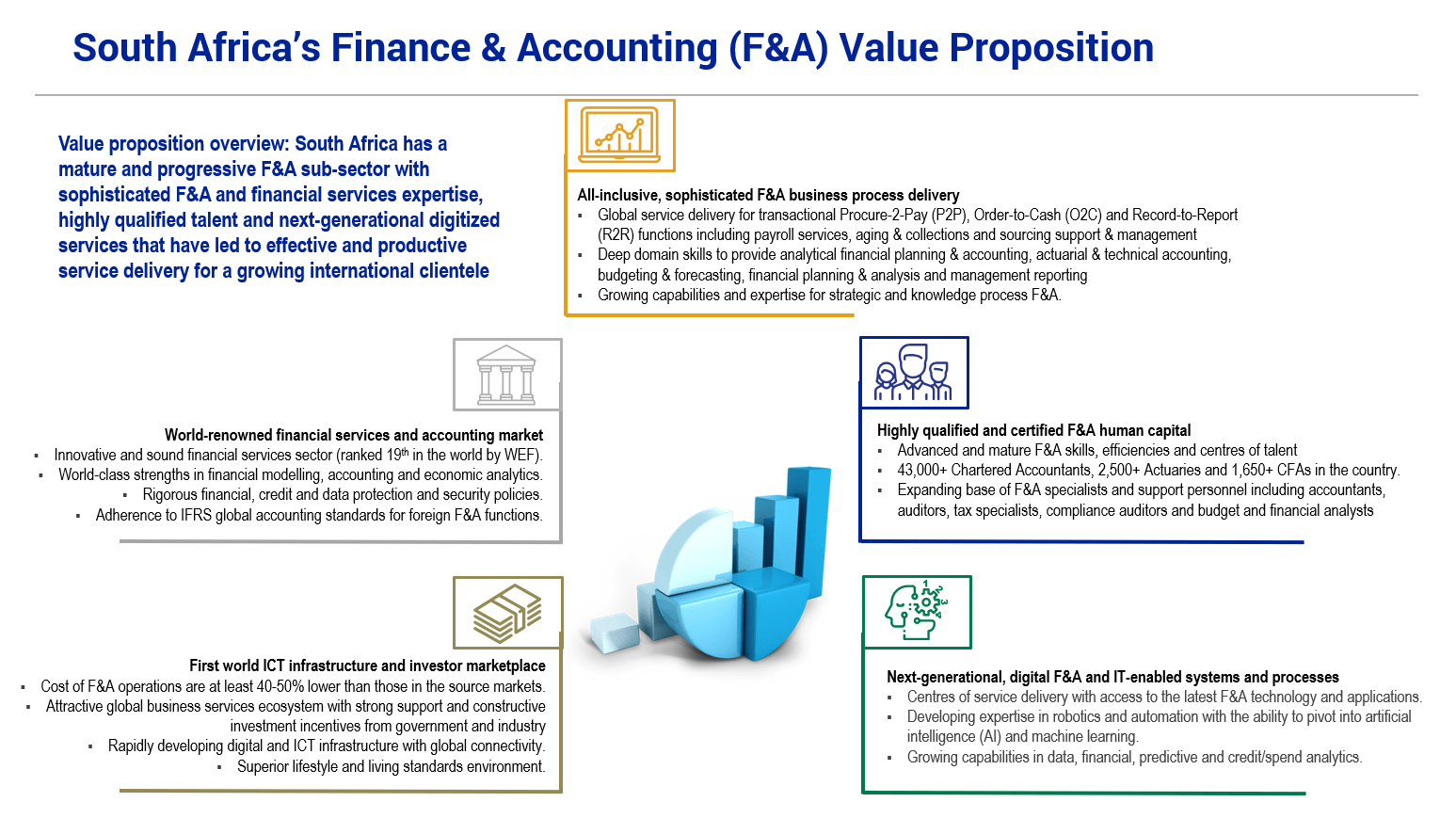

Finance & accounting (F&A)

South Africa is one of the leading nations for its offshore finance & accounting (F&A) services potential and investment opportunities. The country was ranked 4th overall out of 40 countries rated for offshore location favourability. Several of its F&A support and service functions were ranked 8/10 or 9/10 by global executives and buyers. The country’s digital F&A expertise, enabling environment and analytical capabilities are all attractive factors for investors. South African F&A operators service clients across the African continent in addition to global countries such Australia, Canada, France, Germany, the United Kingdom and the United States.

In short, on evaluation of data gathered from both buyers and service providers, the South African finance & accounting (F&A) value proposition emerges as:

- Global service delivery for Procure-2-Pay (P2P), Order-to-Cash (O2C) and Record-to-Report functions.

- Growing capabilities and expertise for strategic and knowledge process F&A.

- 43,000+ Chartered Accountants, 2,000+ Actuaries and 1,650+ CFAs in the country.

- Next-generational, digital F&A and IT-enabled systems and processes.

- World-renowned financial services and accounting market.

These are the core pillars that provide South Africa with a competitive advantage in the global F&A market.

Source: 2019 South Africa Finance & Accounting Market Intelligence Report

Human resource outsourcing (HRO)

South African HR, recruitment and learning service providers are increasingly placing and training talent in other countries on behalf of multinational companies that require diverse and reliable pipelines of skills and expertise. the country was ranked 3rd overall out of 50 countries for HR services delivery. Global HRO buyers indicated a strong interest in outsourcing various workforce management, recruitment, learning/training and benefits administration services to the country.

In short, on evaluation of data gathered from both buyers and service providers, the South African human resource outsourcing (HRO) value proposition emerges as:

- Established and credible capabilities in employee lifecycle management, labour relations and HR strategy.

- Recognised credentials in benefits administration processes.

- Reputable blended learning, training and skills empowerment capabilities.

- Over 70+ RPO agencies with next-generational, digital-enabled expertise.

- Globally recognised knowledge, skills and workforce market.

These are the core pillars that provide South Africa with a competitive advantage in the global HR market.

2020 South Africa HRO Market Intelligence Report

Procurement services

South Africa facilitates reputable procurement, supply chain and logistics services with certified and compliant global business processing skills backed by digitally-proficient e-procurement capabilities and delivery centres. The country has well qualified, experienced and certified procurement professionals, including chief procurement managers (CPOs) and MCIPS professionals.

In short, on evaluation of data gathered from both buyers and service providers, the South African procurement services value proposition emerges as:

- Global service delivery for transactional Procure-2-Pay (P2P), order management, requisition and PO processing functions.

- Well qualified, experienced and certified procurement professionals.

- Digitally-proficient e-procurement systems and processes.

- Globally connected ICT infrastructure and supply-procure chains.

- Adherence to CIPS Standards for Procurement and Supply.

These are the core pillars that provide South Africa with a competitive advantage in the global procurement services market.

Source: 2019 South Africa Procurement Outsourcing Market Intelligence Report

Incentives

ITES and ITO Services

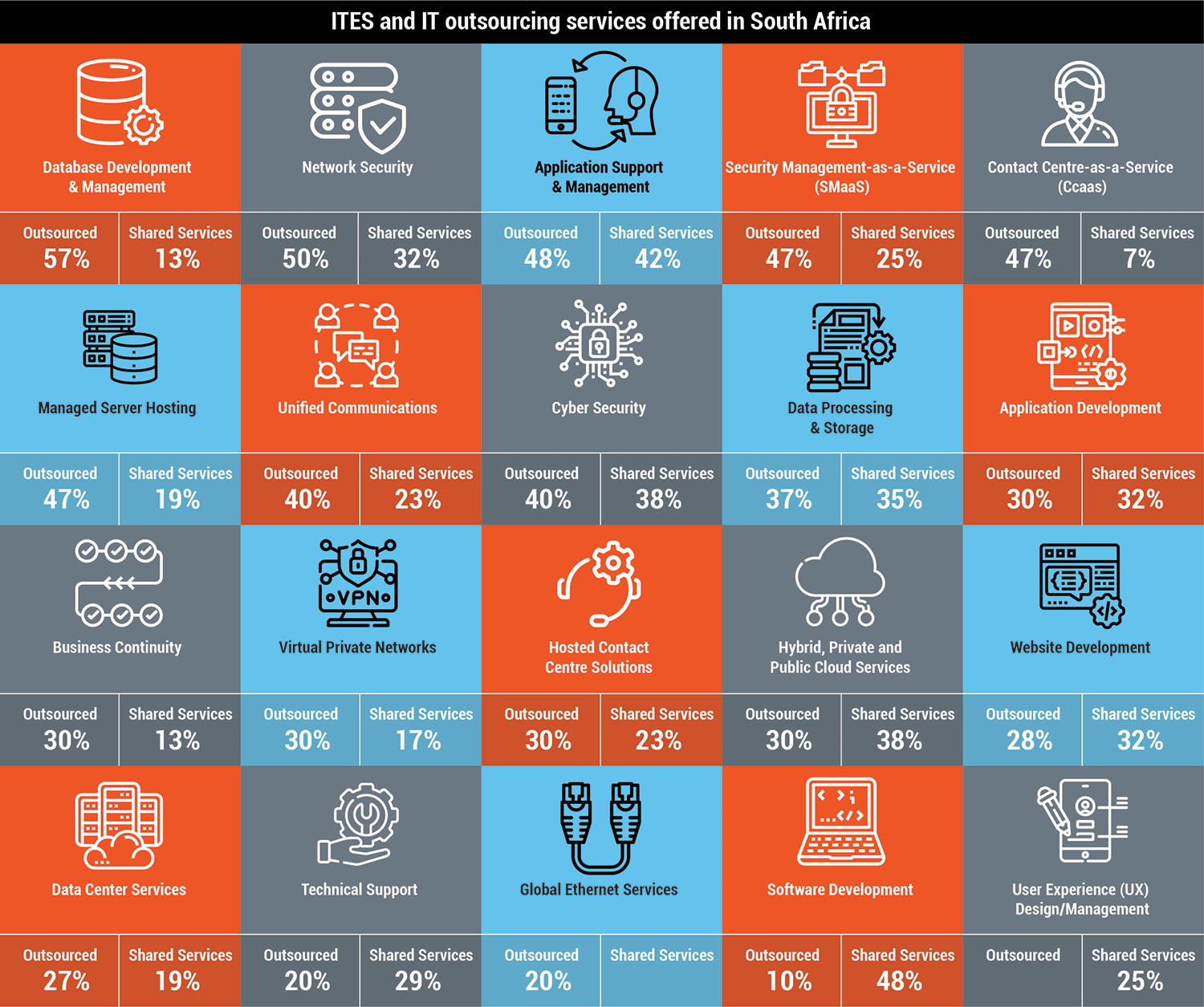

IT-ENABLED SERVICES AND IT OUTSOURCING

South Africa is one of the most technologically advanced countries in Africa, boasting highly developed IT infrastructure platforms and telecommunications networks.

The country has also embraced the digitalisation trend with a robust data centre network and significant investments from technology giants such as Google, Microsoft and Amazon. These investments have seen the data centre network expand significantly across the country, which has introduced a broad array of digital-ready solutions into the business and consumer markets.

South Africa is also a hub of innovation within specific industries, with vibrant fintech and electronic banking, e-commerce, aerospace engineering, biotech and pharmaceuticals, data mining and analytics, and digital marketing sectors.

Database development/management, network security and application support/management are the leading global IT outsourced services delivered from South Africa. There are also growing capabilities in technical support services and software development.

Large Talent Pool

There is a high availability of proficient English talent in South Africa, both written and spoken, with neutral accents and very high empathy levels. The current population of English speakers in the country is estimated to be 16.5 million with 410,000 English speaking individuals added to the national workforce each year. The youth population in the country (aged 18 – 35 years) is estimated to be 17.6 million. There are also pools of foreign speaking individuals that can service the Dutch, German, French and Italian markets.

Deep Domain Skills

South Africa prides itself on its ability to offer both entry level customer service work as well as complex back office and niche domain services.

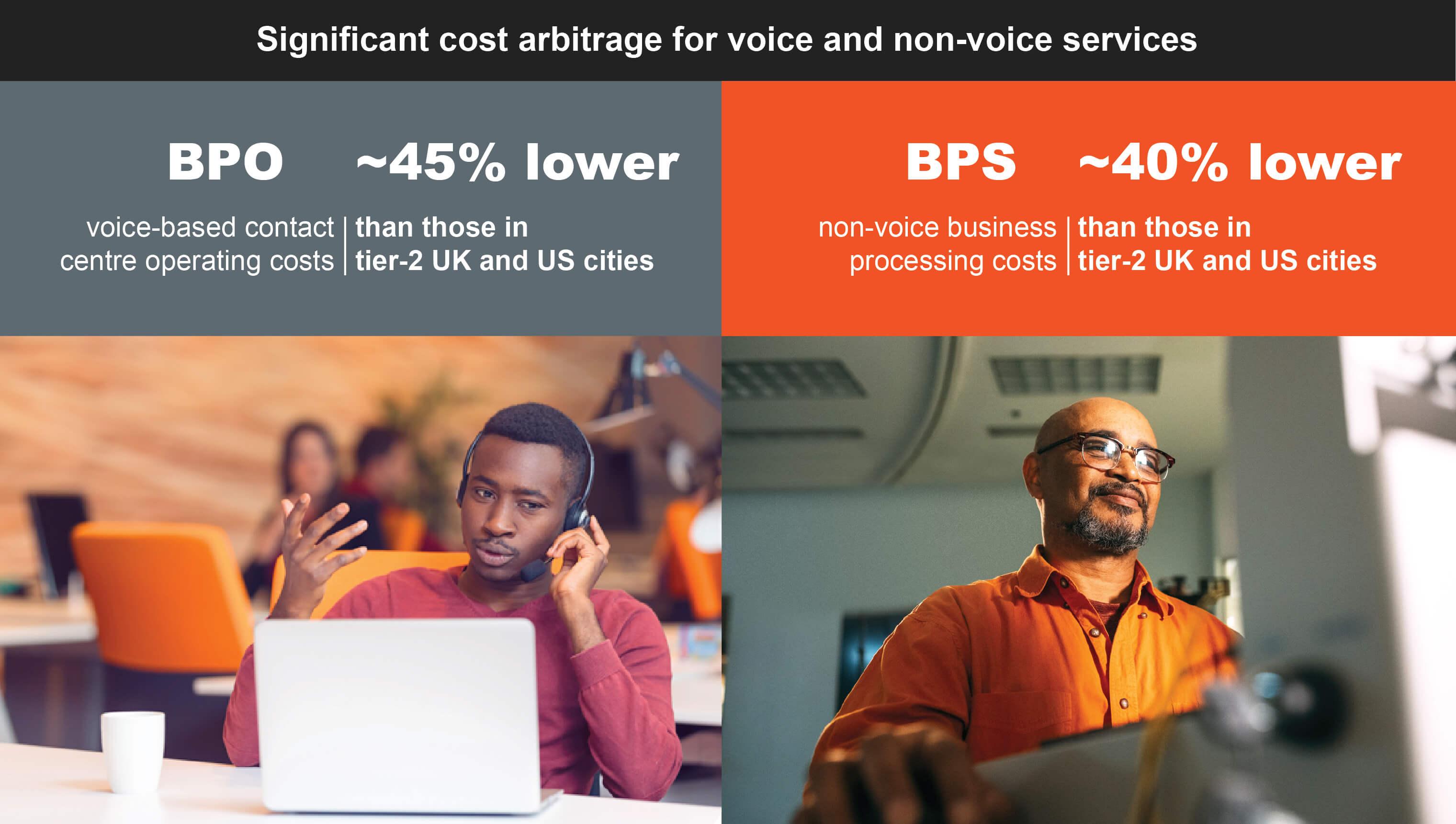

Cost

South Africa offers major cost savings to source destinations such as the Australia, the UK and the US of at least 40 - 45% on a steady-state operating basis (including overheads). This is supplemented by a national BPS incentive through the Department of Trade and Industry (dti) which pays prospective investors up to R290,000 per job created.

Infrastructure

South Africa’s infrastructure is world class, from road and power through to education, healthcare and entertainment, making it a conducive business and investment destination.

Robust Enabling Environment

The South African government works closely with the private sector, industry bodies and investors to create an enabling business environment. This is augmented by key partnerships between the industry association and international bodies such as the Rockefeller Foundation, the Global Impact Sourcing Coalition (GISC) and the International Association of Outsourcing Professionals (IAOP).

Vertical Industries Serviced

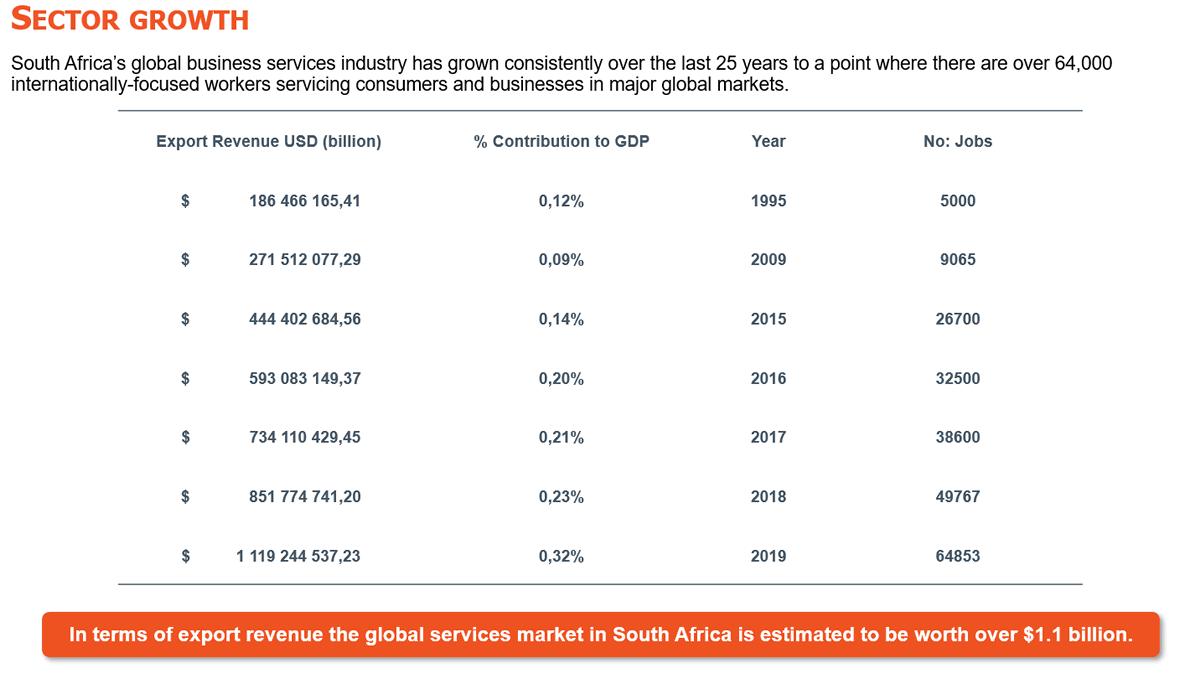

Country Sector Growth

Impact Sourcing

BPESA, along with the Rockefeller Foundation, has played an important role in championing the Global Impact Sourcing Coalition (GISC) which is a collaboration between businesses for creating jobs for people who otherwise have limited prospects for formal employment.

This foundation connects buyers and suppliers through the world’s first Impact Sourcing Directory and provides support to companies measuring Impact Sourcing programmes and evaluates the effects of these programmes on society.

South Africa offers a very comprehensive ecosystem of enterprises, service providers, training academies and industry support which assists in identifying, training and hiring IS workers. Impact sourcing now consists of more than one-fourth of the global services market in the country. This is mainly driven by the contact centre industry which hires a large proportion of unemployed high school graduates who qualify as IS workers.

Companies are now aware that they have the opportunity to make a greater social impact and that the talent pool IS offers is usually more stable, with committed workers that deliver exceptional results for the industry.

Lifestyle

South Africa is one of the most beautiful countries with a lifestyle to match. From fine dining to outdoor adventures to world class schooling, it’s an expat experience that is hard to beat. Below are some details and links that will give you a window into why South Africa is one of the best places to live in the world.

Awards & Rankings

Compliance & Regulations

Land, Mobile, Internet

South Africa’s telecommunications infrastructure is considered to be the continent’s most advanced in terms of technology deployed and services provided, with a network that is 99.9% digital and includes the latest in fixed-line, wireless and satellite communication.

*Source: ICASA

Broadband Connectivity

“South Africa Connect” is the government’s national broadband policy and associated strategy and plan. The vision for broadband in South Africa is “a seamless information infrastructure by 2030 that will underpin a dynamic and connected vibrant information society and a knowledge economy that is more inclusive, equitable and prosperous.” Targets set for 2030 include a 100% penetration at 10Mbps and 80% penetration at 100Mbps.

This information has been supplied by Internet Solutions.

Fibre Network

South Africa’s fibre network is extensive and currently connects the major metropolitan areas of Durban, Cape Town, Johannesburg, Pretoria/Tshwane and Port Elizabeth with other major cities and business centres nationally, regionally and globally.

Global Links: Undersea Cables

South Africa’s total international internet bandwidth (Mbps) capacity increased by 61.7% from 2016 to 2017. According to ICASA, international outgoing bandwidth increased by 81.2% to 244,006 Mbps and incoming Internet increased by 50.9% to 366,394. South Africa’s undersea cables link the country to the global communications grid and include:

|

CABLE |

CAPACITY |

|---|---|

|

East African Submarine Cable System (EASSy) |

10 Tbps (10,000 Gbps) |

|

West African Cable System (WACS) |

5 Tbps (5,000 Gbps) |

|

Seacom |

12 Tbps (12,000 Gbps) |

|

SAT-3/SAFE |

0.78 Tbps (780 Gbps) |

|

SAex |

72 Tbps (72,000 Gbps) |

The following infographic shows how Internet traffic from a local device reaches an international server as well as the different connection points of the undersea cables across the African continent.

EASSy

The Eastern African Submarine Cable System, better known as EASSy, went live in July 2010. The 10,000km EASSy cable system connects South Africa to Sudan and connecting cable networks in Europe, Asia and the Americas. The EASSy cable system has a capacity of 10 Tbps.

WACS

The West Africa Cable System (WACS) was launched in May 2012 with a design capacity of 5.12 Tbps. The 17,200km WACS fibre optic submarine cable system spans the west coast of Africa, starting at Yzerfontein near Cape Town, South Africa and terminating in the United Kingdom.

Seacom

The Seacom 15,000km cable system runs on the East Coast of Africa, and connects South Africa to London. Seacom launched with adesign capacity of 1.28 Tbps, and increased its capacity to 12 Tbps in May 2014.

SAT-3/SAFE

SAT-3 connects South Africa with Europe on the West Coast of Africa, while SAFE provides redundancy on the East Coast by connecting the country to Malaysia. SAT-3 has a capacity of 340 Gbps while SAFE has a capacity of 440 Gbps.

South Atlantic Express (SAEx1)

The South Atlantic Express (SAEx1) is a 72 Tbps submarine cable system connecting South Africa directly to the US, Brazil and the US, with branches to Namibia and Saint Helena.

Telecom Costs

As a result of liberalisation measures as well as the significant number of international submarine fibre optic cables landing in South Africa, the cost of telecommunications has reduced considerably in recent years and this downward trend is expected to continue.

- Landlines: the average cost of a landline is around R200 ($14) per month, with combined phone and Internet packages starting at around R600 ($42) per month.

- Mobile phones: 90% of the national territory is covered by a GSM network. Most major international phones work in the country.

- Internet: coverage in South Africa is mostly restricted to urban areas and some users are restricted to dial-up as broadband availability is limited, though improving. Prices start at around R700 ($49) a month.

- Wireless broadband: is available in the cities and hotspots are ubiquitous in hotels, cafes, and other public areas.

|

Services Available |

Poor |

Satisfactory |

Good |

Indicative Pricing |

|---|---|---|---|---|

|

Internet |

|

|

Good |

1 Gbps unlimited data |

|

VoIP |

|

|

Good |

$0,14 per minute |

|

Mobile |

|

|

Good |

$0,05 - $0.21 per minute (local) |

|

Fixed Line |

|

|

Good |

$0.02 - $0.04 per minute |

|

Wireless |

|

|

Good |

$40 for 100 GB of data per month |

Office Grading

Commercial property in South Africa is generally referenced as either Premium, A, and B grade offices. These can be explained as follows:

- Premium Grade (P): Top quality, ultra modern, new development, high rise or secure office park environment, good parking ratio, superior finishes, security and location.

- A Grade (A): Modern office building, high rise or office park environment with good parking ratio, superior finishes and good security.

- B Grade (B): Generally older buildings but with modern finishes, refurbishments and rennovations, on-site parking.

Office Rentals and Operating Costs

The office rentals applicable to the commercial building grades are as follows:

|

Province |

Grade |

Average Monthly Rentals |

|---|---|---|

|

Cape Town |

P Grade |

R250 ($17.28) per m² |

|

Durban |

P Grade |

R210 ($14.52) per m² |

|

Joburg |

P Grade |

R222 ($15.35) per m² |

|

Pretoria/Tshwane |

P Grade |

R195 ($13.48) per m² |

|

Port Elizabeth |

P Grade |

R145 ($10.02) per m² |

|

Cape Town |

A Grade |

R143 ($9.89) per m² |

|

Durban |

A Grade |

R140 ($9.68) per m² |

|

Joburg |

A Grade |

R144 ($9.96) per m² |

|

Pretoria/Tshwane |

A Grade |

R135 ($9.33) per m² |

|

Port Elizabeth |

A Grade |

R115 ($7.95) per m² |

|

Cape Town |

B Grade |

R127 ($8.78) per m² |

|

Durban |

B Grade |

R131 ($9.06) per m² |

|

Joburg |

B Grade |

R117 ($8.09) per m² |

|

Pretoria |

B Grade |

R103 ($7.12) per m² |

|

Port Elizabeth |

B Grade |

R93 ($6.43) per m² |

Escalation on rentals

On average 8% to 9% per annum

Parking Bays

R700 (R48) to R1500 ($104) per month/reserved single basement bay

Utilities

R47/m² ($3.25) to R55/m² ($3.81) per month for general office consumption costs

Water

R19.25 ($1.33) to R30 ($2.08) per KL for commercial consumption

NOTE: All figures exclude VAT at 15%.